reverse sales tax calculator texas

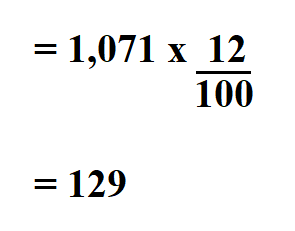

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. Then use this number in the multiplication process.

Reverse Sales Tax Calculator De Calculator Accounting Portal

PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes.

. For example if you operate your business in a state with a 6 sales tax and you sell chairs for 100 each you would multiply 100 by 6. Before-tax price sale tax rate and final or after-tax price. The Avalara cross-border solution helps you stay compliant with taxes more easily.

Multiply the result by the tax rate and you get the total sales-tax dollars. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Calculating sales tax on a product or service is straightforward.

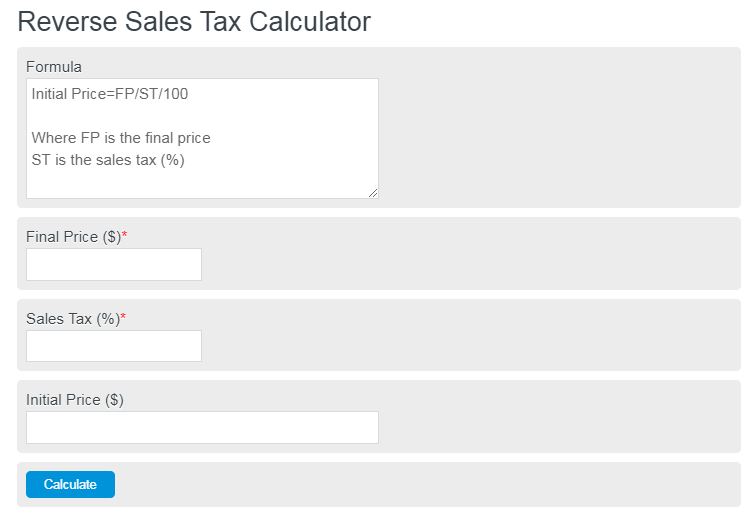

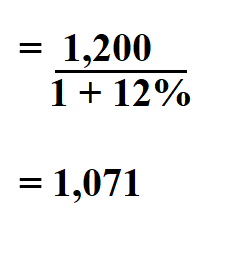

The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax You can calculate the reverse tax by dividing your tax receipt by 1 plus the percentage of the sales tax. Now find the tax value by multiplying tax rate by the before tax price. Integrate Vertex seamlessly to the systems you already use.

Divide your sales receipts by 1 plus the sales tax percentage. Reverse Sales Tax Calculations. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code.

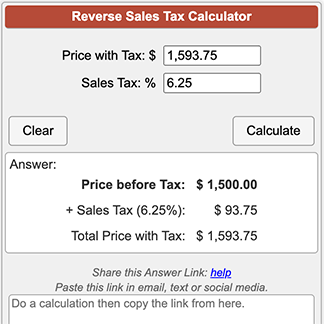

Input the Tax Rate. Total Price Net Price Sales Tax Amount. This script calculates the Before Tax Price and the Tax Value being charged.

Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. The next step is to multiply the outcome by the tax rate it will give you the total sales-tax dollars. 855-335-3500 New Car Sales.

Divide tax percentage by 100 to get tax rate as a decimal. Subtract that from the receipts to get your non-tax sales revenue. Enter the applicable sales tax percentage for the location where you are making the purchase.

Not all products are taxed at the same rate or even taxed at all in a given. To easily divide by 100 just move the decimal point two spaces to the left. Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price.

Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. In Texas can a reverse mortgage be approved if. 855-335-3500 New Car Sales.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. How to Calculate Sales Tax.

Simply multiply the cost of the product or service by the tax rate. The formula looks like this. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

The formula looks like this. To save you from doing the calculations manually I have included the following reverse sales tax calculator for calculating the before-tax price and sales tax amount from the final amount paid. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax.

Purchase Location ZIP Code -or-. For example suppose your sales receipts are 1100 and the tax is 10 percent. Price before Sales Tax Final Price 1 Sales Tax If you need to use the Tax sales Calculator for several products at once it is handy to use Excel per formulas and.

Formulas to Calculate Reverse Sales Tax. Tax 111 tax value rouded to 2 decimals Add tax to the before tax price to get the final price. How do you add 6 sales tax.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Now find the tax value by multiplying tax rate by the before tax price. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax. The reverse sale tax will be calculated as following. Ad Avalara can help you with global item classification tax calculation filing and more.

Before-tax price sale tax rate and final or after-tax price. Divide 1100 by 11 and you get 1000. We can not guarantee its accuracy.

Find list price and tax percentage. Tax 1480 0075. Multiply the price of your item or service by the tax rate.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. Price before Tax Total Price with Tax - Sales Tax Sales Tax Rate Sales Tax Percent 100. The final price including tax 1480 111 1591.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Input the Tax Rate. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to.

Calculator formula Here is how the total is calculated before sales tax. Net Sale Amount Total Sale 1 sale tax rate 105000 105 100000 Sale Tax total sale net sale 105000 100000 5000 As we can see the sale tax amount equal to 5000 which the same to above calculation.

How To Calculate Sales Tax Backwards From Total

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

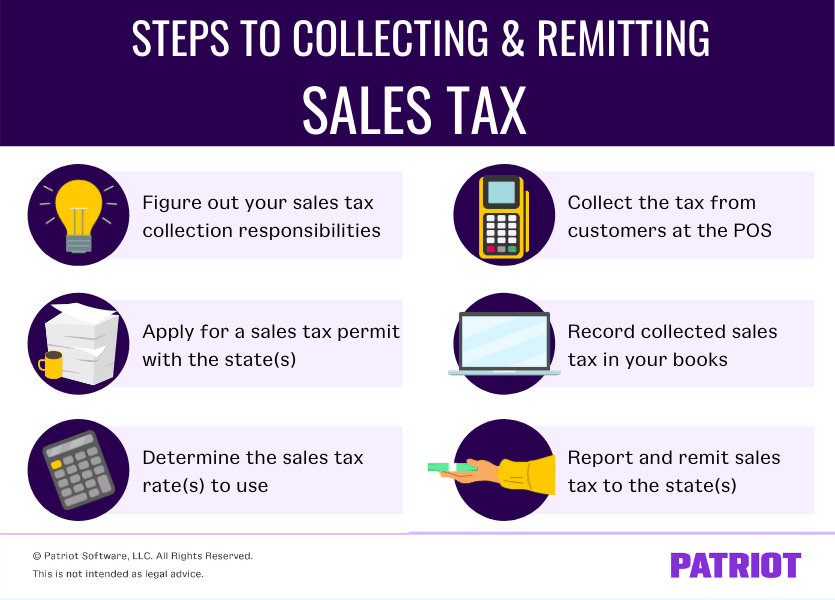

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Kentucky Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total Reverse Tax Calculator

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax Backwards From Total

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator 100 Free Calculators Io

Quebec Tax Calculator Gst Qst Apps On Google Play